The Power of Partnerships: Exploring Joint Homeownership Trends

Financial decisions often intertwine with personal relationships, and choosing to co-own a home is a pivotal milestone for many couples. JW Surety Bonds set out to understand the complexities behind joint mortgages by surveying 1,000 Americans in romantic relationships about their thoughts on home co-ownership. Their tales of finance versus romance offer insights into the evolving nature of joint property ownership. Join us as we discuss the timing, rationale, and broader implications of this major step in a relationship.

Key Takeaways

-

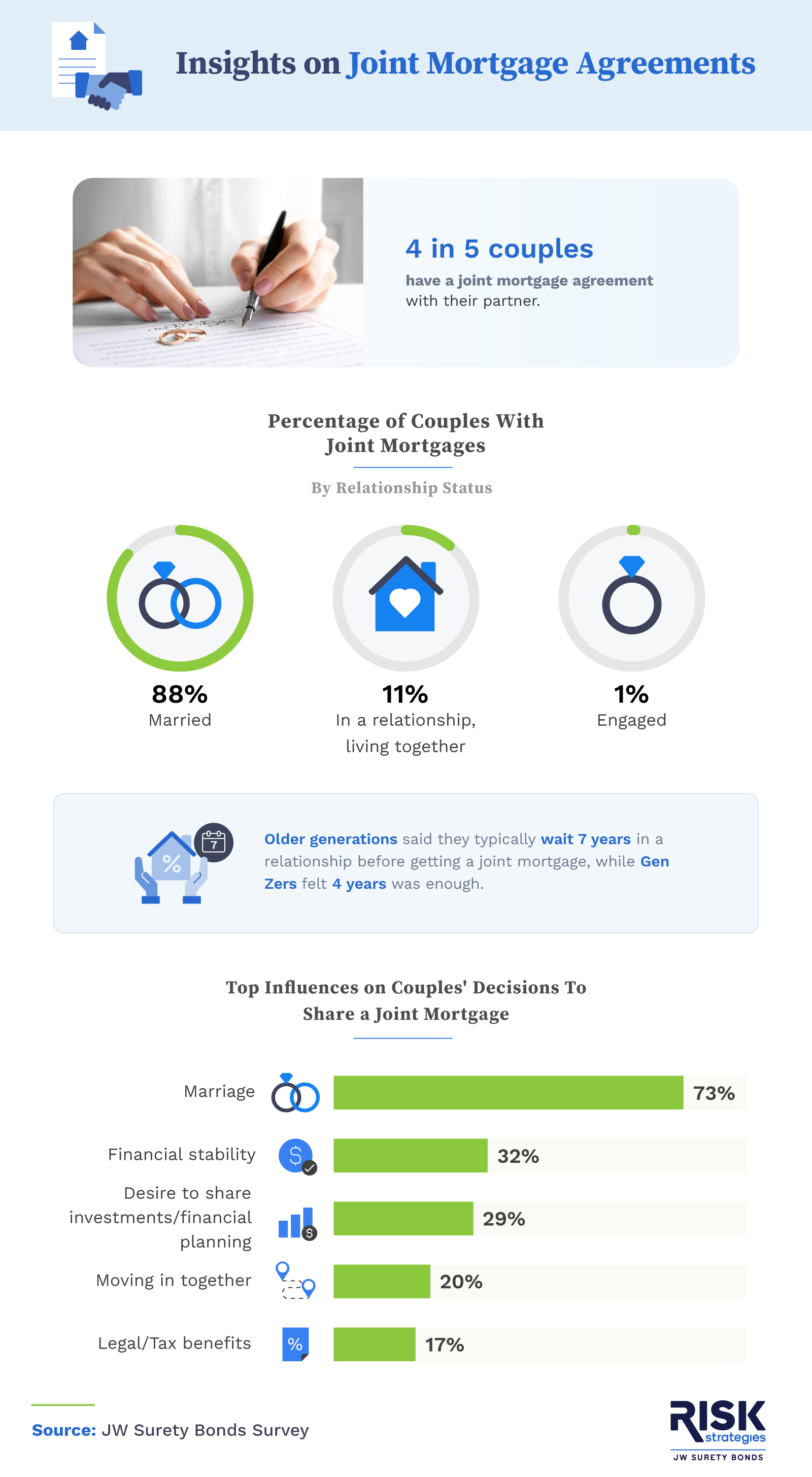

4 in 5 couples have entered into a joint mortgage agreement with their partner, with 32% doing so to attain financial stability.

-

Older generations typically wait 7 years in a relationship before getting a joint mortgage, while Gen Zers feel 4 years is enough.

-

75% of Americans expect their partner to contribute towards the mortgage payments when cohabiting, even if they are not co-signers on a joint mortgage

-

Over 10% of couples would not be willing to split a mortgage with their significant other without a legal contract like a prenuptial agreement in place.

-

If mortgage rates dropped, 40% of couples without a joint mortgage would hasten their decision to get one.

Motivations, Marital Statuses, and Generational Trends

- 4 in 5 couples have a joint mortgage agreement with their partner.

- Just 3% of couples who share a mortgage have a prenuptial or similar legal agreement. Over 10% of couples who don’t share a mortgage would require such an agreement before doing so.

- 88% of couples with a joint mortgage are married, 11% are unmarried and living together, and 1% are engaged.

- Older generations typically wait 7 years in a relationship before getting a joint mortgage with a partner; Gen Zers wait just 4 years.

- Americans’ primary reasons for obtaining a joint mortgage are:

- Marriage (73%)

- Financial stability (32%)

- Desire to share investments/financial planning (29%)

- Older generations have an average 4% mortgage interest rate, while Gen Zers face a higher rate of 6%.

- The most commonly perceived risks of sharing a mortgage are:

- Legal complications in the event of separation or divorce (43%)

- Risk of financial loss in case of a breakup (38%)

- Financial dependency or imbalance (25%)

- The most commonly perceived benefits of sharing a mortgage are:

- Financial stability and shared responsibility (47%)

- Investment in a shared future and assets (39%)

- Better loan terms due to combined financial resources (33%)

- Women are nearly 20% more likely than men to have a joint mortgage with their partner.

- More than 50% of millennials share a mortgage with their partner, compared to just 10% of baby boomers.

When To Buy and How To Share Home Costs

- 84% of American couples feel it’s acceptable to buy a house with a significant other before getting married.

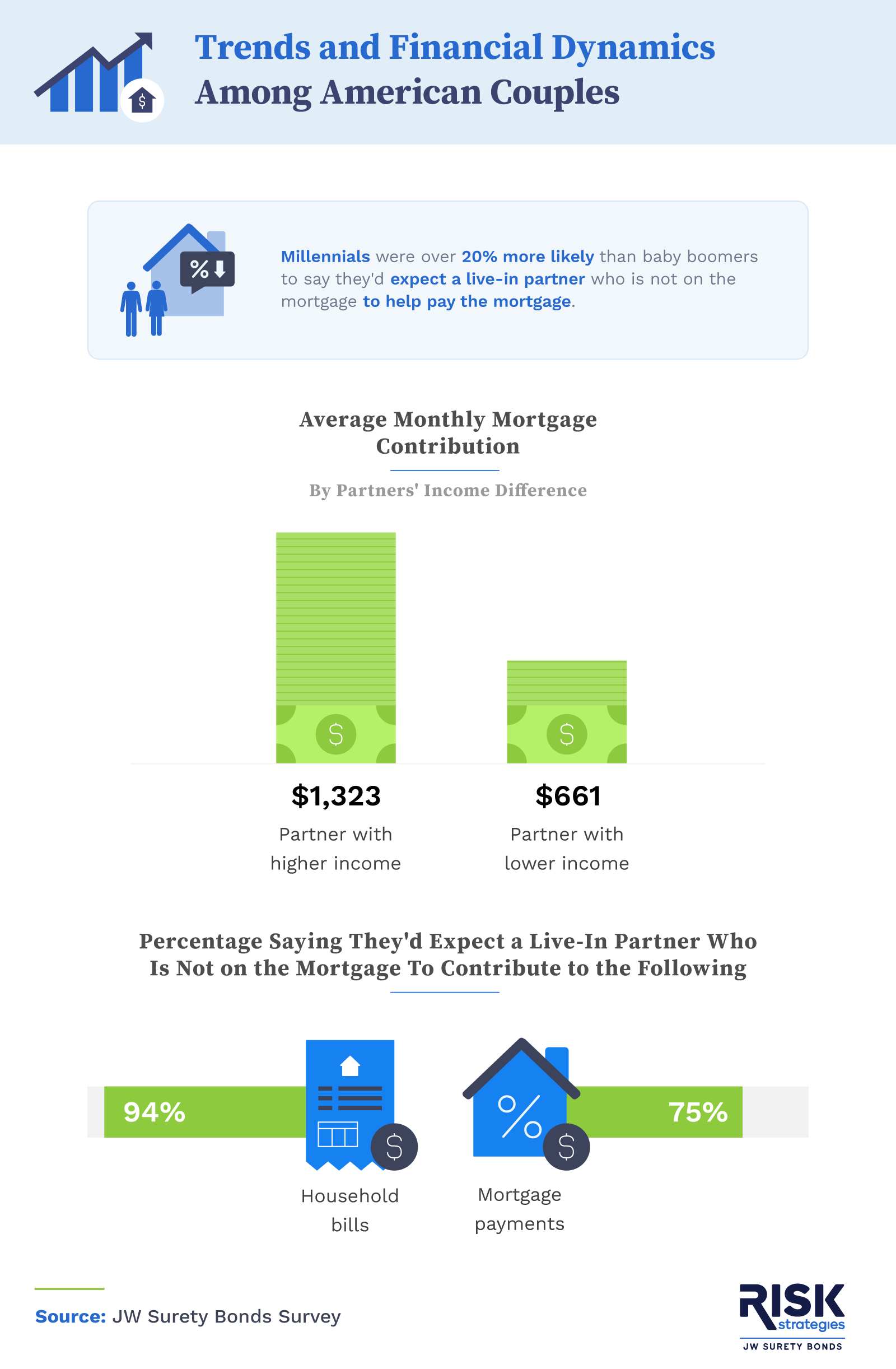

- People with a higher income than their partner pay an average of $1,323 per month for their shared mortgage, while those with a lower income pay $661.

- 94% of Americans would expect a live-in partner not listed on the mortgage to help pay for household expenses; 75% would expect them to help pay the mortgage, with millennials over 20% more likely than baby boomers to say so.

- 40% of couples without a joint mortgage would hasten their decision to enter one if mortgage rates go down.

Methodology

JW Surety Bonds surveyed 1,000 Americans about trends and factors behind couples’ decisions to co-own a home through joint mortgages. The average age of respondents was 43 years. The gender breakdown of respondents was 46% male, 53% female, and 1% non-binary. The generational representation was 9% baby boomers, 33% Gen X, 56% millennials and 2% Gen Z.

About JW Surety Bonds

With a commitment to excellence and a deep understanding of the bonding industry, JW Surety Bonds offers businesses and individuals a wide range of surety bond solutions. Whether you need a performance bond, a construction bond, or any other type of surety bond, our team of experts makes JW Surety Bonds a trusted partner in achieving your goals and protecting your interests.

Fair Use Statement

If you’d like to share these trends and factors influencing couples’ decisions to co-own a home through joint mortgages, we welcome you to share our findings for noncommercial purposes. Please ensure a link is included on this page to give your audience access to our research.

Leave a Reply